Are you having a hard time getting accurate information when it comes to your food stock holding?

Café and restaurant accounting firm Sky Accountants talk about Food Stocktake Calculator

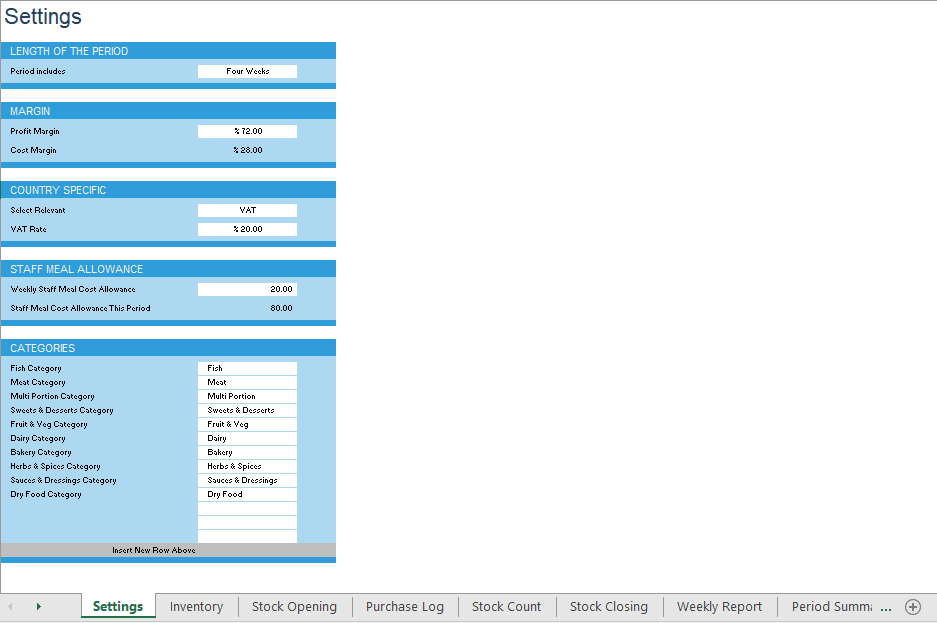

A Food Stocktake Calculator may help you track your restaurant‘s food stock by categorising your food stock under different groups such as meat, fish, fruit and vegetables, dairy, sweets and desserts, bakery, etc. Doing this will help you analyse the product purchase cost, available stock and gross profit organised by specific groups.

Get a quick glance of the cost of your inventory at opening, cost variances, forecasted profit margins and actual profit margins by using this Spreadsheet123 Food Stocktake calculator. This way, you will be able to track the information weekly or monthly.

Café and Restaurant Accounting

First, add the quantity of all purchased items, cost of the purchased items, count, category and the cost of the whole food stock into the spreadsheet. You can then create an inventory list and break it down by food item name, category, purchased units by size, package or weight. You can also enter the cost of purchase unit, number of purchased units, count and unit cost – and define “unit” by yourself.

Once done, you can start recording opening stock and track stock movement every week. Take the stock at the same time every day so you can get the exact variance based on purchase log, stock count and stock closing values. This will give you accurate stocktake figures each week and an overview of your food stock on the “period summary” sheet. Talk to your restaurant and café accounting firm for more details.

Total gross profit is the difference of the “gross receipts” and “net receipts” minus sales tax. You can calculate the variance by subtracting “targeted profit margin” from “gross profit margin.” If your variance is in the negative, that means your performance is poor based on your plan. The “targeted profit margin” percentage is your planned value of growth.

Multiply variance with net receipts and you get the Cost Variance – this should be in the positive to indicate good performance. If it’s in red, it probably means loss for your business. Cost of goods sold, on the other hand, is the sum of “cost of inventory at opening” and “purchases” minus the sum of “staff meal allowance” and “inventory at closing.” Get this figure weekly or monthly.

If you want to use this Food Stocktake Calculator or have questions about your inventory, click here

Need a bit of assistance with your hospitality business? Contact a Sky Accountants representative today and learn more about our fixed fees. You won’t regret it.

Some of our clients include Buckley’s Entertainment Center, Ballarat Leagues Club, Daylesford Hotel, Bacchus Marsh Golf Club, Campbell Point House, Midlands Ballarat, The Urban Newtown, Maryborough Midland Society, Brink Drinks, Dontek, UV Wraps and many more.

Aside from business consultation, we also offer restaurant and café accounting, bookkeeping, back office, SMSF and POS services designed to help you achieve greater financial success.

You can click here to speak to a business, accounting and bookkeeping firm. We also offer hospitality business consultation and mortgage services. We will give you a call to know more about your needs. We will explain to you how we can improve your business.

Email Address: [email protected]

Sky Accountants Ballarat

Phone: 1300 328 855

Office Address: 902 Howitt Street, Wendouree, Victoria 3355, Australia

Postal Address: PO Box 2234, Bakery Hill, Victoria 3354

Sky Accountants Gisborne & Macedon Ranges

Phone: 03 97444522

Office Address: 45 Hamilton Street, Gisborne, Victoria 3437, Australia

Postal Address: PO Box 270 Gisborne Victoria 3437

Source: Spreadsheet123